Today’s topic is Visual ERP Accounts Payable. You are the unsung heroes, managing a lot of paperwork and keeping people happy – I’m here to help! Here are seven questions I am commonly asked:

#7. Can you “unvoid” a check and AP voucher?

Unfortunately, you cannot unvoid a check. This is a one way street. You will need to redo the payment with a dummy check #. If the original check was 45678, you could enter a different one such as 145678. If you fill in the number when you are setting up the check, you do not need to reprint.

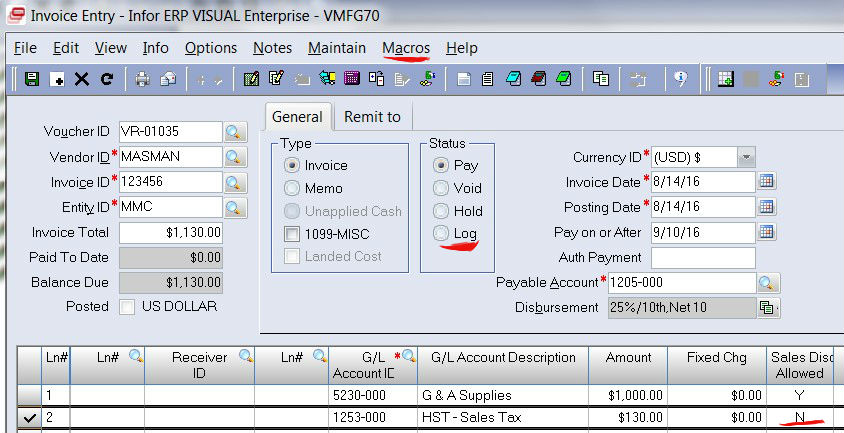

#6. We take prompt payment discounts, but it is wrong because it calculated on the total invoice amount. The tax (HST/GST) should not be considered for the discount calculation. Can we get VISUAL ERP to do this?

Yes, VISUAL can handle this. On the Accounts Payable line, there is a column called “Sales Disc Allowed”. The default is Y, but it could be set to N on the Tax lines. It might be hard to remember to do it every time, but a macro could be written to automatically change the field to N. If you have VAT enabled, there is a setting that can be made in vendor maintenance.

#5. We just renegotiated the payment terms with a major vendor. How do I ensure the new terms get reflected on the Purchase Orders and open Accounts Payable Invoices?

First change the terms in Vendor Maintenance. Then you might want to change the Purchase Orders but that’s not necessary. As new PO’s are created, the new terms are picked up. When you generate the payments, there is a check box “Override Invoice Terms with Vendor Terms”. That means the due dates will be calculated based on the new terms in vendor maintenance not what is on the invoice.

#4. I keep giving invoices to “Ted”, our plant manager, and he keeps losing then. He says I never gave them to him. Is there any way VISUAL will help with this?

You betcha. When you get the invoice, record it into VISUAL, but instead of setting the status to Pay or Hold, set it as Logged. VISUAL will record all the information but NO accounting entries are made. You can even add a note to the voucher “Gave it to Ted.” Visual will time & date stamp entry. Periodically, you can run a list of logged invoices, and you can track them (or him) down. Once the invoice is approved, just change the status to Pay or Hold & save the invoice.

#3. I have some Accounts Payable Invoices where the Purchase Order received amount is different than the invoice amount. What is the best way to record these? Should I send them back to Purchasing to fix? Should I add an extra line and let it slide?

The answer to this will be dependent on the controls in your company. There are a couple of options:

Option 1

- PO is returned at the wrong price.

- PO cost is changed to the correct price.

- PO is received at the new price.

- Record an AP invoice with all 3 lines (Receipt, Return and Receipt). But you need to ensure that Costing Utilities is run so the cost on the Return is updated. If this is not done then there is the possibility of putting the PO Accrual account out of balance.

Option 2

- Get approval from purchasing that the price is correct. If it is incorrect, that is a different story & different day.

- Record the AP invoice and override the amount to the invoice value. You can do this providing the vendor matching is set to “not checked” or the amount is within the tolerance for vendor matching.

- If you are actual costing, Visual ERP will update the received value to the invoice value. If you are standard costing, the difference goes into the Purchase Price Variance account.

I do not recommend adding an extra line for the difference because the operations folks would never know the real price.

#2. Is there a canned report to show if the taxes (HST/GST) are calculated correctly?

If you are using VAT tax, then there are some canned reports available in AP Invoice Entry window.

If you are inserting lines for taxes, VISUAL ERP does not have a canned report. I have created queries that compares the invoice amount and the tax amount, and the queries show the percentage of tax versus the invoice so it makes it easy to spot problems.

#1. My Purchase Receipt Accrual Account does not equal my General Ledger balance. How can I find the differences?

There are a variety of things that can cause the PO Accrual account to go out of balance. Some things are:

- Timing of receipt – received in the current month but the invoice was recorded last month.

- Unposted entries.

- Incorrect postings which could be a variety of reasons.

If you really want to find it quickly, there is tool available that looks for all the different causes. Not only does it find the problems, it provides methods for fixing each of the problems, and not with General Journal Entries.

For further information, or if you need help with any other areas of Infor VISUAL ERP, please get in touch, we’d love to help!