Do you recall the TV show, Frasier? He was a radio talk show psychiatrist played by Kelsey Grammer. People would call in with their various issues. He would provide all kinds of wisdom. His radio tagline was “Good afternoon, Seattle. I’m listening”. Sometimes I feel like Frasier Crane but to the Visual community.

To give you a flavour for what our “show” might look like, I have selected a few of the calls or emails we have received recently. I thought some people might have similar questions, so anything to help.

If we had a real show, it would start out “Hi, I’m Kim from Canada. I’m listening”.

Candy & the Cancelled Work Orders

Kim – Hello, Candy, – What can I do for you?

Candy – There is a cancelled work order that is hitting the COGS G/L. I suspect this was because the materials and labour were issued, then the work order cancelled, then the materials returned afterwards. Is there an easy way of reversing this? Any pointers would be awesome!

Kim – If the materials are returned, then the cost in the work order should be zero. It is showing 98K. Once you get it to zero, then you could run full costing to create an updated posting or use Costing Tools to trigger the 1 work order. This should reverse the 98K.

Candy – I presume there would be some sort of warning if a work order was attempted to be cancelled with WIP entries. I’m not 100% sure what went on with the job, but out of morbid curiosity theoretically a cancelled sales and associated work order could have work against it, where would the costs of that typically be held if there is not a sale?

If finished goods weren’t made but, say, subcomponents completed I assume they should have been booked to stock and the costs tracked to inventory. Would that be the correct flow?

Kim – No warning is given. Setting the WO to cancelled is the option to use if you are scrapping a work order. In this case, the cost goes to COGS accounts associated with the Product Code on the Work Order. I have had some clients change the Product Code to Scrap and have the COGS account set as scrap costs. Thus, the costs are posted to scrap not the COGS account which is typically related to customer sales.

If it is possible to salvage the work order, then it could be received to stock. You could even change the part being made by adding a co-product Part ID, assigning 100% of the costs to the new part ID and receiving the new part to stock. The work order would need to be set to closed since no quantity would be received on the main part ID on the WO. Hope that helps.

Candy – That solves the mystery. Thanks. I can report back to our team.

Barry and the Missing Inventory Balance Report

Kim – Hi Barry. How can I be of assistance?

Barry – Our July inventory valuation report show $8 million but the inventory balance report shows only $3.4 million. I have to admit I am kind of freaking out about this. What happened? How can we fix?

Kim – I suspect Costing Tools was used in July prior to manufacturing journals being created for July. If the Journal Prep button is used to try and force a value to post, then Visual thinks that full costing has been run for the month of July. For example, it may have 1 record in the Inventory Balance (IBR) table for July. When full costing is run, the IBR is created for July, it looks at the last IBR, which is only 1 record, then adds and subtracts the new transactions. In this case, it means anything on the June IBR will be dropped off unless there is new activity related to that transaction. So, you will drop June balances. I know this far too well because I had accidentally done this numerous times on some Visual databases early in my Visual career.

Barry – How do we fix the cancelled work order costs?

Kim – Great news. Visual has an option under costing tools to recalculate the Inventory Balance Report. You could run this without any part ID’s selected and it would look at your entire database from the beginning of time. This may take a bit of time depending on how many inventory transactions you have in your database.

Barry – Our database is over 15 years old so I am concerned that it will take too long. Any other options?

Kim – If you know the part ID’s that are out of balance, you could run for those ones only. That way you don’t have to look at parts that may not be used thus taking less time. Since you have been working with the Inventory Deep Dive Reconciliation Tool you have a couple of options that can help:

- If you run the Inventory Rollback it is similar to comparing the Inventory Valuation versus Inventory Balance Report. This report will identify the problem parts.

- We have just added an option for Deep Dive to find the missing records and even add them to the July IBR. This option is way faster and less time consuming.

Penny & the Increasing Part Costs

Kim – Hi Penny. What’s on your mind?

Penny – We noticed our costs have increased on our assemblies this month but can’t find a reason as to how or why. All related work orders are set up the same. The only place we found a difference was on the part maintenance where the cost went from approx. $10 per unit to $571 per unit. Also, is there a transaction that someone could do that might change this data without knowing or understanding what they did?

Kim – First of all I don’t think anyone is doing anything to impact the costs since work order costing is updated by Costing Utilities and FIFO layers updates.

Here’s a few things you can do to investigate this situation:

1. Have the first 2 steps of Costing been run? This impacts the values on out transactions and work order receipt values. If they have not been run then the information is not yet finished and thus could be giving you wrong values.

2. Can you determine the work orders that are the source for each transaction? You can research the work orders with one of the following:

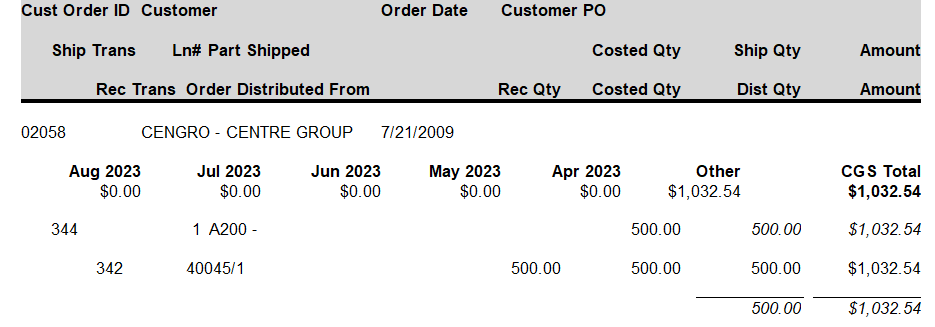

a. First step would be running the Cost of Goods Sold Report (Admin, Costing Tools), Enter Customer Order ID, then Option: Margin. Or you could use Cost Distribution Report for the specific Part ID for the date range you are looking at.

i. Either report will show the out transaction (shipment).

ii. Then it will show the source of the cost. More than likely the work order.

b. Once you know the work order, go to Manufacturing Window, select the Work Order. Then go to Info – Costs.

i. This will show the estimates, actuals and projected costs.

ii. Can you identify any parts which have a large variance?

iii. Are the work orders completed? If a work order is partially completed, then Visual could be using Estimated Costs to calculate the projected cost. The latter is then used to value the receipt.

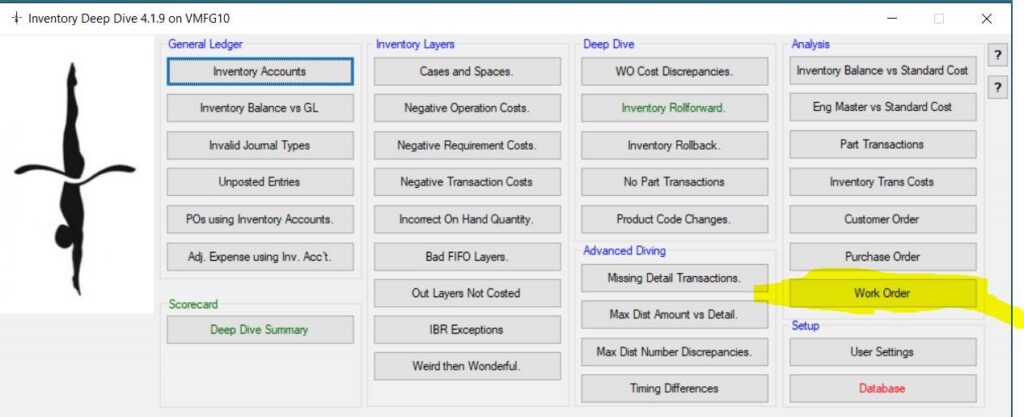

c. Or you can use Inventory Deep Dive Reconciliation Tool – under Analysis – Work Order. Enter the Work Order which will show you all the transactions related to the work order. You could do this for the high cost and the prior low-cost work orders.

a. Then research the following:

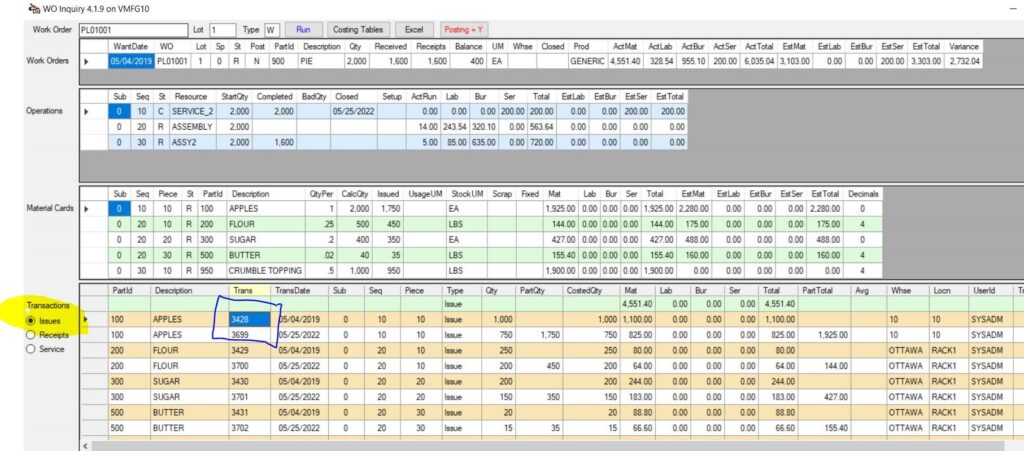

i. Under Transactions select – Issues as shown below.

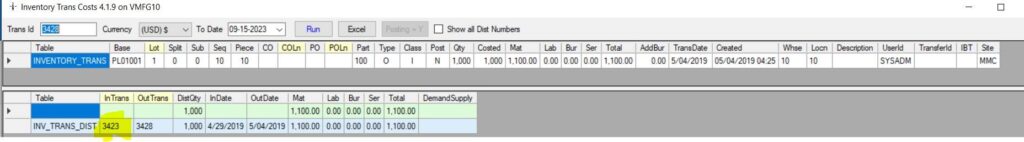

If one of these transactions is too high, click on the Transaction ID (example blue box), which will open up another window detailing the transaction costs.

· Look at the FIFO costs. (INV_TRANS_DIST section) which shows the transaction which is the source of the cost.

· Then click on the In-Trans ID (yellow highlight) which will take you to the source of the costs. Have a look at the 1st section. Do you see anything odd on the In Trans value?

i. You can also send the Work Order to Excel. There will be a tab for each section of the WO window. If you compare the work order does anything jump out at you?

Hope this helps to explain why the costs are higher. If these are incorrect, check back and we can determine ways to fix the work order costs.

Zeke and Zero Cost Transactions

Kim – Hey Zeke – How can I help?

Zeke – Why is there no cost for some return issue transactions? Is it just a fact that nobody entered the cost when completing the inventory transaction?

Kim – The return issue transaction initially is recorded at zero cost but will be updated with the actual cost from the issues when the 1st 2 steps of Costing Utilities is run. There is no option for anyone to enter the costs. You may want to ensure that the 1st 2 steps of Costing Utilities are run first.

Amanda and Updating Standard Costs

Kim – Good day, Amanda – I’m listening?

Amanda – We have not run any standard cost updates through Visual. I understand imploding costs should be done monthly. Should we complete on a test database first?

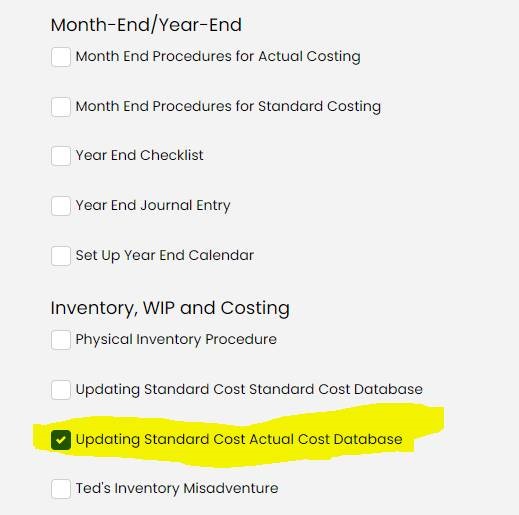

Kim – Some companies run these steps monthly while others run them annually. And some companies run anytime in between. If you want to get familiar with running the process, then doing in a copy of the database is a good 1st step. The detailed procedure can be found on our website. https://backtobasics.ca/visual-erp-downloads-2/ . Select the procedure highlighted below.

Amanda – We would like to attempt this task but need to know what it will impact.

Kim – Once the standards have been updated, they will be used for any adjustments in transactions. It will not restate any previous transactions. It is important to do this prior to a physical inventory count as Visual will use the standard cost for any adjust-in transactions. If you don’t do it there is the possibility of adjusting in inventory at zero cost or a totally wrong cost.

There is one situation where it could have a financial impact. Here’s the scenario:

· Your WIP costing setting is set to Projected.

o You can find this under Admin – Accounting Entity Maintenance – Costing Tab. If you are running Visual 7.0 or below, check out Admin – Application Global – Costing Tab.

· A work order is open and has had some receipts. AND,

· The estimated costs for open work orders are updated during the update standard costing process.

New estimated costs will impact projected costs which is used to value the work order receipts. The projected cost will be used until the work order is closed. Then it is no longer used. So, this scenario is a temporary cost change. Once the work order is completed Visual will use the Actual Costs.

Well, we do hope that you find these different scenarios helpful. And if you are a Frasier fan, you will be glad to hear there is a Frasier Crane reboot show.

If you want answers to more Visual ERP questions, feel free to check out our website for previous blogs, downloads, and general help.