“You are ONLY an accountant.” I can still remember my father saying this to me. But let me give you a little history. My father was an entrepreneur. He started out in the food trade and ended up in the plastics industry. I had the honour to work for him after graduating university. The other interesting thing about my father was he had grade 9 education but he was a charmer and found his niche in sales. So, when he said, “You are only an accountant”, I think he was telling me that my job wasn’t as important as his in sales. I can see where he was coming from. Without sales, us accountants don’t have any beans to count. But it sure felt like an accountant should have been a 4-letter word.

Lately, I have been seeing a trend. Some companies seem to be utilizing non-accountants to do accounting work. I get it. With computers and great software like Visual ERP why not have the computer and these individuals do the work? So what is wrong with that? These people are typically, pretty smart but I am seeing that their inexperience may be impacting how effectively they can do the accounting work. Now maybe, I am feeling slighted that some people do not see the value of an experienced accountant (Is this my ego talking?). Or maybe I am just feeling the “I am only an accountant” comment coming back after all these years. Gee I sound a little traumatized. ☹

But if I really reflect, my passionate response is that in the depths of my soul, I think financial results should be accurate. Numbers tell a story. Managers need good data to assess how the company is doing. Good data means effective decision making which helps the company make more money.

I was going to go on a rant about things I have seen. Rather than a full-on rant, I thought I would just give a few examples and explain how the “missing accounting link” impacts the financial information.

A few things that I have seen:

- Creating customizations without the involvement of finance. This could mean that transactions are not recorded properly which could result in incorrect costs. The missing or incorrect information could impact the profit by part or customer. Would this help when making decisions? Also, sometimes a general ledger account will no longer reconcile because we have “missed” some of the logic that Visual requires. Unreconciled accounts drive me crazy as it means we are misrepresenting financial information. Plus, I look at reconciliations like a puzzle. They need to reconcile. 😊

- Setting up a Shop Resource but not entering an applied labour or burden general ledger account. In this case, the company was understating their profit by 50K per month. This went on for a few months until it was rectified.

- Recording an abnormal transaction to miscellaneous income or expense. In this case, it turned out that the transaction was related to a loan and should have been recorded on the Balance Sheet not the Income Statement. When fixed, the profit numbers changed significantly.

I truly feel people are doing their best but they don’t know what they don’t know. For example, I’m not going to do brain surgery because I don’t know how, no matter how many times I have watched Grey’s Anatomy. Hand me a ten blade. Not.

But I really want to do something that will help instead. So here’s some basic accounting “rules” that might just help whoever is doing or managing accounting.

- 1. Financial statements are made up of two key statements (If you are an accountant, feel free to skip this section).

-

-

- Balance Sheet

- Income Statement

-

- Balance sheet is made up of Assets (what we own). Think inventory, bank accounts, fixed assets or Accounts Receivable. The other major section is for Liabilities (what we owe). In this case Accounts Payable, Loans, Accrued Liabilities. The latter are costs that are related to a prior period that we have not yet paid for. Could be payroll, commission or taxes. Then there is shareholders’ equity. This is the value of the shares and Retained Earnings, which is an accumulation of profits and losses from the beginning of the company’s existence.

-

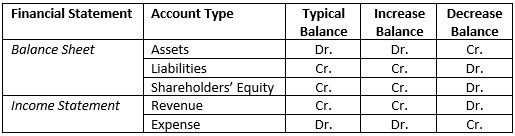

Assets are typically in a Debit balance. Or Dr. to us accountants. Not doctor like my business partner likes to claim.

Liabilities and Shareholders’ Equity are typically Credit balances. Or Cr. That shortform is pretty obvious.

-

- Income Statement is made up of Revenue and Expense accounts. Revenue accounts show as a Cr. balance and expenses show as Dr. balance. If you are testing yourself, that is Debit (Dr.) and Credit (Cr.).

So, when you are thinking about making an entry, do you need to debit or credit an account? Let’s say you want to increase the accrued bonuses for the year. If I am talking to an accountant, I will say, we want to debit the expense account and credit the accrued bonus account. Every debit must have an offsetting credit. If the person I am talking to isn’t an accountant, I will say “we need to increase that account”. This is when it gets a little tricky so I put together this little chart.

- 2. The next accounting concept to follow is “The Matching Principle”. The costs incurred should be matched against the revenue recorded. When we sell a gadget, we also need to record all the material, labour, burden, and service costs or even commissions associated with the sale. If we think about this in terms of Visual- here’s a few things that can be done:

-

-

- Record labour tickets when the work is done. Don’t wait until “you have time”, to get the labour recorded.

- Issue the materials real-time. Don’t think of this as a catch-up process.

- For outside services, record the PO receipts in the same month when the services are provided.

-

All of the above can be automated with bar-coding which could ensure these will happen in real-time.

-

-

- Accrue commission in the month when the goods are shipped. If you use Visual’s commission functionality, it can be done almost “automagically”, or you can create a general journal entry to set up the expense and the accrual. That is Dr. the expense and Cr. the accrual.

-

- 3. All accounts should be reconciled. But what does this mean? Various accounts on the Balance Sheet will have a list that supports it. Think about your inventory. There is a stock list (Inventory Balance Report) that should contain the same amounts as in the General Ledger. Or it could be Accounts Receivable, Accounts Payable, Bank Accounts, Purchase Order Accrual or Work In Process. All of these have supporting lists. These need to stay in sync. If not, you could be in for a rude awakening. You may think you have $2 million of inventory but then find out that there have been some incorrect entries and the inventory is only worth $1.8 million. That $200,000 will reduce your profit. That can be kind of hard to explain. Or think the reverse. You might all of a sudden have more profit than you are expecting. More profit means more taxes.

- 4. Look for old stuff. Looking for expired things in your fridge? How about the same thing in Visual? Here’s a few areas:

-

-

- Older Accounts Receivable invoices. Is a collection call required? Or maybe there is a credit memo that needs to be generated. Or was the payment applied to the wrong customer account?

- Older Accounts Payable Invoices. Should these have been paid? If they are negative, should you be requesting a refund from your vendor?

- Outstanding payments greater than 6 months old – These would be stale-dated and more than likely will NOT be accepted by the bank. To fix you would:

-

-

-

-

-

-

-

- Void the payment in the current month

- Create a replacement payment to pay the vouchers

-

-

-

-

-

-

-

- Are there any old or closed work orders on the WIP Balance report? If they are old, does the want date need to be updated on the work order? Or does the work order need to be cancelled if it will never be finished or if it was closed with no received quantity? Cancelled work orders will be expensed thus remove the amounts from the Balance Sheet.

-

-

I get it. Our world is changing. We are moving some of the repetitive work to computers or even the customers. When was the last time you used the self-checkout at the grocery store? I am pretty sure even the grocery store accountants are checking their books to ensure accurate reporting of profit and the Balance Sheet.

Okay, I will get off my soapbox now. I feel better.